The CARES (Coronavirus Aid, Relief and Economic Security) Act was passed by Congress and signed into law in March 2020. It authorized fast and direct monetary assistance to American taxpayers, businesses and local governments.

This economic relief package totaled $2.2 trillion, and the Internal Revenue Service (IRS) is in the process of making $250 billion in payments to individual taxpayers. And of course, this large amount of money has attracted the attention of worldwide email scammers and con artists. They will attempt to steal these funds by any means possible.

By understanding how the funds are distributed and taking precautions, you can avoid being a victim of these cyber-criminals.

IRS CARES Payments

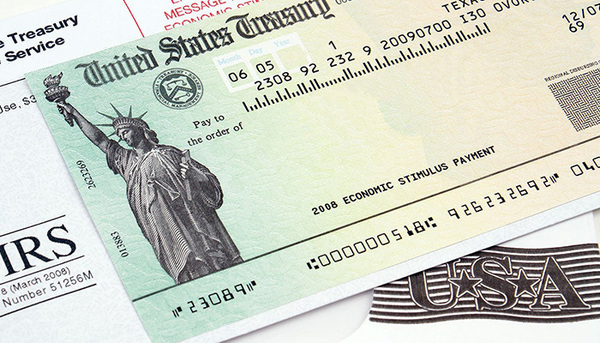

About 80 million Americans who filed taxes in 2019 and 2020 and provided direct deposit bank account information will receive stimulus payments directly to their bank account. Checks will be mailed to those who do not provide direct deposit information to the IRS.

The IRS will not call you or email you. The organization will not send you a text, or place notices on social media or any website other than their own website (www.irs.gov). If you receive a phone call, text or email asking for your bank information so you can get your payment, do not respond. It is a scam. Hang up the phone, delete the text and never click on links in suspicious emails.

Taxpayers who didn’t provide direct deposit information previously can do so by using the Get My Payment application on the IRS website. Checks will be mailed to those who do not provide direct deposit information to the IRS.

Recognize the Scams

Scammers will tell you they have inside information that allows you to receive your money faster—but only if you provide your social security number and bank account information. Once they have that information, they can access your personal accounts and take your money.

Others may even ask for the information of qualifying children to collect even more. Some scammers may send a fake check for more than the amount from the economic relief payment and ask the victim to send the overpayment back in cash, Western Union money transfer service or gift cards.

Be aware that phone scammers prey on retirees who are especially vulnerable. They will ask the person to confirm his/her bank account or social security number over the phone and later use that information to defraud the retiree.

The IRS is the only organization that will distribute economic stimulus or economic security checks from the CARES Act. IRS representatives will never work through third parties or contact you directly. For more information, go directly to the IRS website and select Coronavirus Tax Relief.